Defi – Towards More Resilient and Transparent Financial System

In the 1900s and some parts of the early 2000s, the focus primarily has been towards mass growth via manufacturing and offering in large quantities. It is only recently that the shift has happened (at least in some parts of the world) towards premium quality by turning towards selectivity, safety, transparency, and buoyancy as well. This gradual transposition has been under the radar in almost every industry irrespective of a firm’s nature, size, or whether it’s a private or a public organization. In the financial services sector also, the transformation has taken the path of moving from an authoritative functioning system into a decentralized ecosystem. Blockchain as a platform and decentralized applications like DeFI (decentralized Finance), DApps (decentralized applications) like smart contracts have replaced the prior generation way of executing a task.

Very subtly mentioned by Thomas Puschmann, that digital development in the BFSI (banking, financial services, and insurance) sector consists of 3 phases. The phases are internal digitalization (banks focusing on automation of financial services like payment transactions, portfolio management, etc), provider-oriented automation (integration of core banking systems), and lastly customer-oriented customization (imbibing employment of new IT developments like cloud computing, smartphones, etc). The first two phases have already been deployed on the ground (in most parts of the world), while the third phase is underway. The third phase implementation illustration includes the FinTech solution app called DNAppstore, an electronic toolbox for banks to bundle services from distinct service providers.

The above infographic showcases the transformation which has happened with due credit to technology since the 1980s to date. Besides that, forecasting is also done based on the patterns the technology is evolving and is expected to evolve further in due time. In the early days of the Internet, information was the key focal area, which changed to services since 2000. The expected modification from services is likely to happen is in values. This could also be seen as selective customization in subtle ways for every customer/individual.

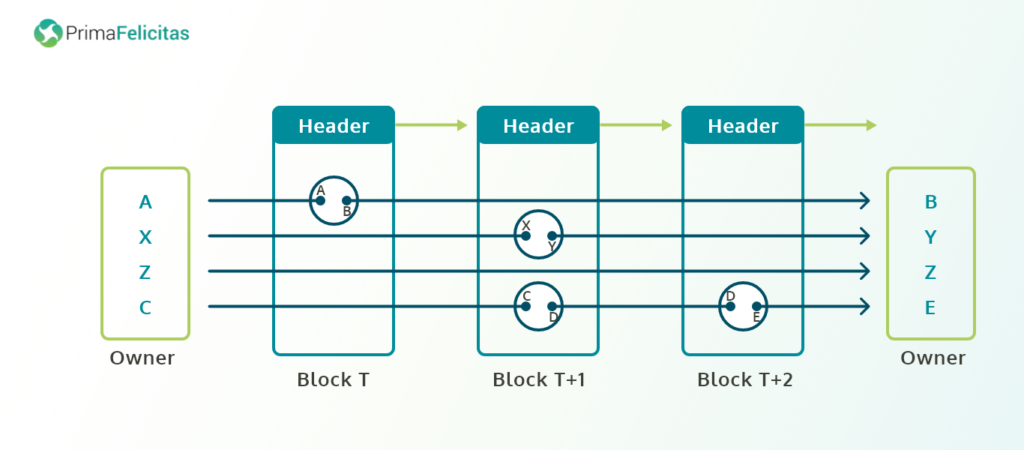

As the saying goes, “Better late than never”, central banks across nations are acknowledging the fact that it’s high time to change the way of executing tasks with regards to payment of money across digital platforms. Francois R. Velde puts it eloquently that IT’s ‘I’ can now process the information leading to the new opening of avenues. He emphasizes the employment of Distributed Ledger Technology (DLT); usage of Tokens, Bitcoin, and Blockchain as well. The infographic displayed below is just a small crude illustration of the working of Blockchain at the backend. While transferring data from one cluster of individuals to another cluster of individuals, the data gets broken down. After this, certain information is added in every step which only succeeds if users of both clusters know the specific information, making the transaction safe and secure. Unique encryption and decryption algorithms are deployed among various other blockchain protocols to make the data nearly hack-free.

As mentioned, and listed in this piece of research, numerous pathways have been developed enriching sectors via imbibing blockchain’s application DeFI. Some of them include health administration and governance, environmental governance, social aspects of computing, meta-analysis, and web 3.0 – a decentralized web. Another illustration showcasing higher resilience and transparency through decentralized finance besides the above piece of research is this research which tells us (figure 1) that current regulation of STO’s is increasing across the world. With over 50% in the United States of America, following Switzerland, United Kingdom, and Germany as well.